Modern Monetary Theory explains that a country that issues its own currency (like the UK and USA), can instruct its Central Bank to credit the money into an account. Governments may also record how much tax they receive, and although the amount may influence spending, it is not dependent on it. Taxes do not fund spending, despite what politicians and many economists may claim. Countries that do not issue their own currency include those using the Euro in the European Union, so they do not have monetary sovereignty.

The evidence that taxes do not fund spending

1. Legally, money can only be issued by the government. When the UK Government wants a new aircraft carrier, the UK Parliament instructs the Bank of England to issue the money, regardless of the amount of tax collected (Exchequer and Audit Departments Act 1866, Section 15, points 1 and 2). In the USA, the House and Senate pass legislation, and Congress authorises the spending, and the US Treasury instructs the Federal Reserve bank, to make payment on its behalf.

2. In 1965 tax revenues were £10bn. By 2022 UK spending had increased to £1,200bn. Clearly £10bn of taxes did not magically grow into £1,200bn. The explanation is that the UK borrowed the extra money. But in 1965, the National Debt was £31bn, equivalent to the money invested in the economy, so the UK could not have borrowed more than this amount.

3. When you pay your tax demand that is due, your tax obligation is extinguished, and the money paid is deleted and ceases to exist. It is similar to paying back a loan. The balance of your tax account no longer has any money left to fund anything:

| Tax due: | −$1,000 |

| Tax paid: | +$1,000 |

| Balance (Tax available for government spending) |

$0.00 |

“There is no such thing as public money; there is only taxpayers’ money.”

— Margaret Thatcher (Speech to Conservative Party Conference, 14 Oct 1983)

Thatcher’s statement is nonsense!

The Government spends into the economy

Government must first spend money into existence, investing in all of us, and allowing the economy to function; taxes provide a means to remove the money that was originally issued by the Government.

A thought experiment allows us to see that this is correct: Imagine a country with no money, and a Government that introduces a new currency tomorrow. Today, as there is no money in the economy, taxes can not be collected as no-one has any money. Only after a government has issued money and invested it into the economy, can taxes be collected.

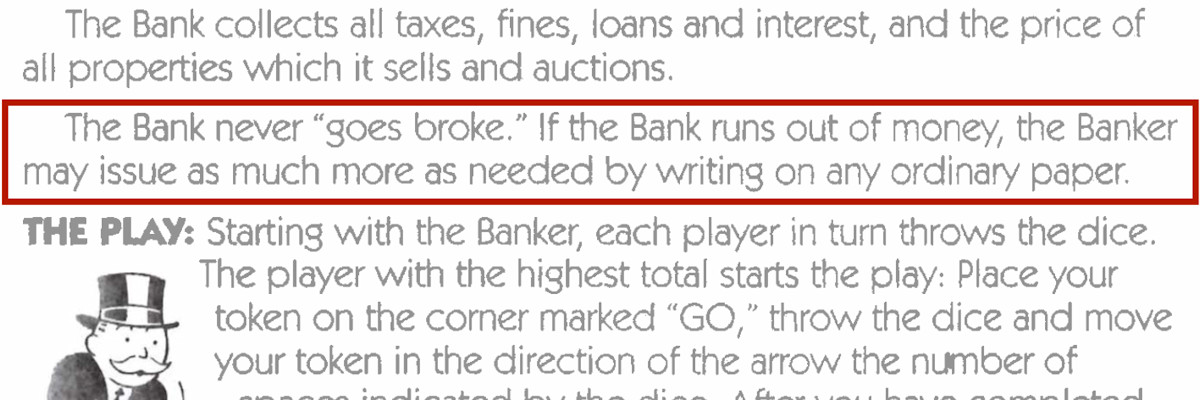

This is exactly how a game of Monopoly is played: the banker first gives money to each player, only after which can the game be played, properties can be bought and sold, and rent and taxes be paid. The taxes do not fund the bank, as the bank has all the money it wants. This is stated in the rules of the game:

“The Bank never “goes broke.” If the Bank runs out of money, the Banker may issue as much more as needed by writing on any ordinary paper.”

Implications

Since governments do not rely on taxes for subsequent spending, governments never have to ask “where will we find the money” or “how will we fund our spending”. The government is not like a household, and does not have to budget like one. Yes, that may seem counter-intuitive. Yes, there may be political reasons why a government chooses to portray “tax and spending” in the way that it does; for example, a government may want to reduce spending to less than it can.

So political decisions determine how much money the government wants to spend, the money is always available. So a government can, for example, guarantee full employment, and invest in rebuilding the country.

Consequently, there is no government debt, and taxes do not fund spending: because spending does not need to be “paid for”.

So what are taxes for?

- Taxes create a demand for the currency (making willing sellers of goods and services for money.)(Randall, see references below)

- Taxes help keep the currency strong.

- Taxes can help fight sin and reward charity.

- Taxes help manage inflation (taking money out of the economy)

Who says that taxes do not fund spending?

Henry Ford and Thomas Edison, who in the 1920s joined forces to explain how the government could pay for a hydroelectrical plant:

The Government needs $40,000,000. That is 2,000,000 twenty-dollar bills. Let the Government issue those bills and with them pay every expense connected with the completion of the dam… the entire $40,000,000 issued can be retired out of the earnings of the plant.” (Steve Keen, 2023, quoting the New York Times, Dec 6, 1921)

Economist Abba P. Lerner wrote:

“An interesting, and to many a shocking, corollary is that taxing is never to be undertaken merely because the government needs to make money payments”, Functional Finance and the Federal Debt, in Social Research, vol.10 no.1, February 1943, page 44.

British economist William Beveridge wrote:

“There is no financial limit to spending by the State within its own borders, as there is a financial limit, set by their resources and their credit, to spending by private citizens.” (Beveridge, 1944)

Beardsley Ruml, the Chairman of the Federal Reserve Bank of New York:

“At the end of World War II, the Chairman of the Federal Reserve Bank of New York (the most important branch of the Federal Reserve System), Beardsley Ruml, said the same thing in a paper he titled “Taxes for revenue are obsolete.”11 While taxes might be important for other purposes (that we’ll examine later), government doesn’t need “revenue” in order to spend.” (Randall, p. 19 quoting: Beardsley Ruml, “Taxes for Revenue Are Obsolete,” American Affairs, vol. 8, no. 1 (January 1946), pp. 35–9.)

Federal Reserve Bank Chairman Ben Bernanke said:

“It’s not tax money. The banks have accounts with the Fed, much the same way that you have an account in a commercial bank. So, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It’s much more akin to printing money than it is to borrowing.” (Bernanke, 2009)

Prof. William Mitchell et al:

“.. the tax flows that national governments receive are certainly not intrinsically necessary to facilitate government spending [..] This sounds shocking because we are so accustomed to thinking that taxes pay for government spending [..] in the case of a government that issues its own sovereign currency without a promise to convert at a fixed value to gold or foreign currency [..] taxes are not needed to pay for government spending” (Mitchell et al, 2019, p.323)

Prof. Stephanie Kelton:

“Taxes are critically important, but there’s no reason to assume the government must raise taxes whenever it wants to invest in our economy. [..] Your taxes don’t actually pay for anything, at least not at the federal level. The government doesn’t need our money. ” (Kelton, 2020, pp. 22)

The UCL Institute for Innovation and Public Purpose writes:

“the UK Government creates new money and purchasing power when it undertakes expenditure, rather than spending being financed by taxation from, or debt issuance to, the private sector” (Berkeley, A. et al, 2022, Abstract) [..] “.. all spending arises as new money advanced as credit and not ‘from taxation’” (Berkeley, A. et al, 2022, Section 3.3)

Dirk Ehnts writes:

“The new perspective also debunks as a myth the notion that “the taxpayer” finances government spending. Since the government is always creating new money as it spends, tax payments do not serve to finance it. [..] For each dollar, the federal government owes us a reduction of tax liabilities of the amount printed on the bank note or the amount transferred electronically. US dollar bills read: “I-egal Tender for All Debts, Public and Private”. Our tax liabilities are the public debts mentioned here.” (Ehnts, 2024, p.11)

References

-

- Wray, L. Randall. Making Money Work for Us. Polity Press.

- Kelton, Stephanie. The Deficit Myth: Modern Monetary Theory and How to Build a Better Economy (p. 22). John Murray Press. Kindle Edition.

- Ben Bernanke, quoted in “Ben Bernanke’s Greatest Challenge“, CBS 60 Minutes, March 15, 2009 (CBS Interview on YouTube, 2015)

- William Mitchell (Author), L. Randall Wray (Author), Martin Watts (Author) , Macroeconomics 2019

- Berkeley, A., Ryan-Collins, J., Tye, R., Voldsgaard, A. and Wilson, N. (2022). “The self-financing state: An institutional analysis of government expenditure, revenue collection and debt issuance operations in the United Kingdom“. UCL Institute for Innovation and Public Purpose, Working Paper Series (IIPP WP 2022-08).

- Lord Beveridge, Full Employment In A Free Society, Publ. 1944 Bradford and Dickens

- Steven Keen, “Just Because You Know How to Make Money, That Doesn’t Mean You Know How to Make Money“, Feb 11, 2023. Quoting Henry Ford, also reported in Congressional Record: Proceedings and Debates of the 76th Congress, Volume 85, Part 2, United States Congress, Publisher U.S. Government Printing Office, 1939 “Declare War on Unemployment and Money Shortage“, Nov 3, 1939, page 836.

- Beardsley Ruml, “Taxes for Revenue Are Obsolete,” American Affairs, vol. 8, no. 1 (January 1946), pp. 35–9

- Dirk Ehnts, Modern Money Theory: A Simple Guide to the Monetary System (Professional Practice in Governance and Public Organizations), 2024, Springer.

See also

- We pay for it by spending the money, by Alan Hutchison, Matches in the Dark, Publ. 27th September 2018

- Modern Monetary Theory and the Changing Role of Tax in Society, Social Policy and Society, Volume 19 , Issue 3 , July 2020 , pp. 454 – 469 , Cambridge University Press, Andrew Baker and Richard Murphy

- Jaideep J Pandit, “Modern monetary theory for the post-pandemic NHS: why budget deficits do not matter“, British Journal of Healthcare Management, Vol. 28, No. 1, Publ. 6 Jan 2022

- “Do taxes fund spending?” by Daniel @ Out of the Crooked Timber, September 17, 2021

- “Tax strategy and Government policy“, Dr Rajiv Prabhakar, Insight, House of Commons Library, 3 June, 2021

1:03 “it’s sometimes overlooked as the main way in which money is created — and it runs contrary to the view sometimes put forward — that banks can only lend out deposits that they already have. In fact, loans create deposits, not the other way around.” See also: “Money creation in the modern economy“, Quarterly Bulletin 2014 Q1 @ Bank of England